ESG

Conscious investment goes beyond profit, prioritizing the positive impact on issues such as sustainability and social responsibility. Using ESG principles as a guide in this process allows for considering the environmental, social, and governance aspects in investment choices.

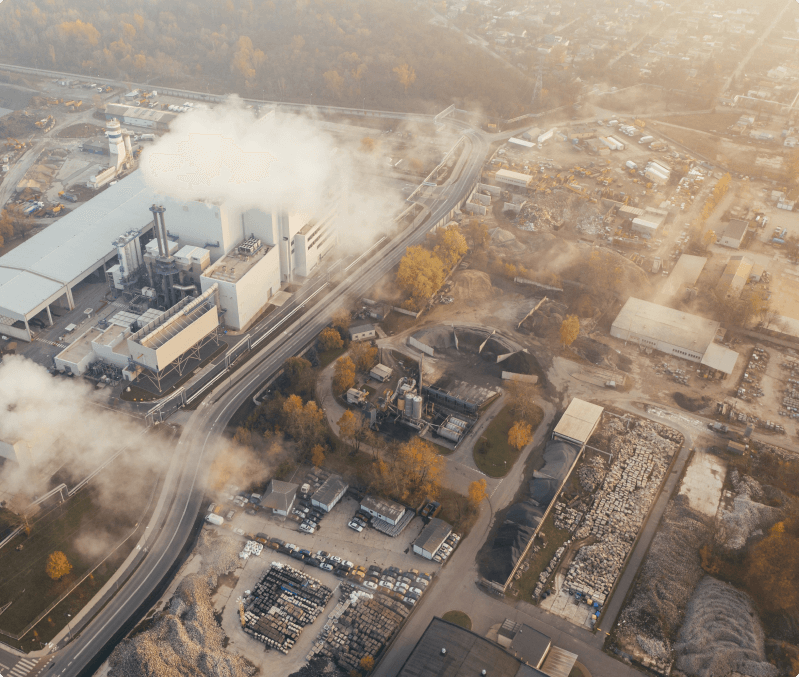

Reducing Environmental Impacts

By investing in low-carbon intensity companies, you actively contribute to reducing environmental impacts, doing your part in the fight against climate change.

- Reduce emissions and make a greener world.

- Invest with purpose and support sustainable companies.

- Direct your capital towards a positive environmental impact.

Rebalancing with a focus on ESG

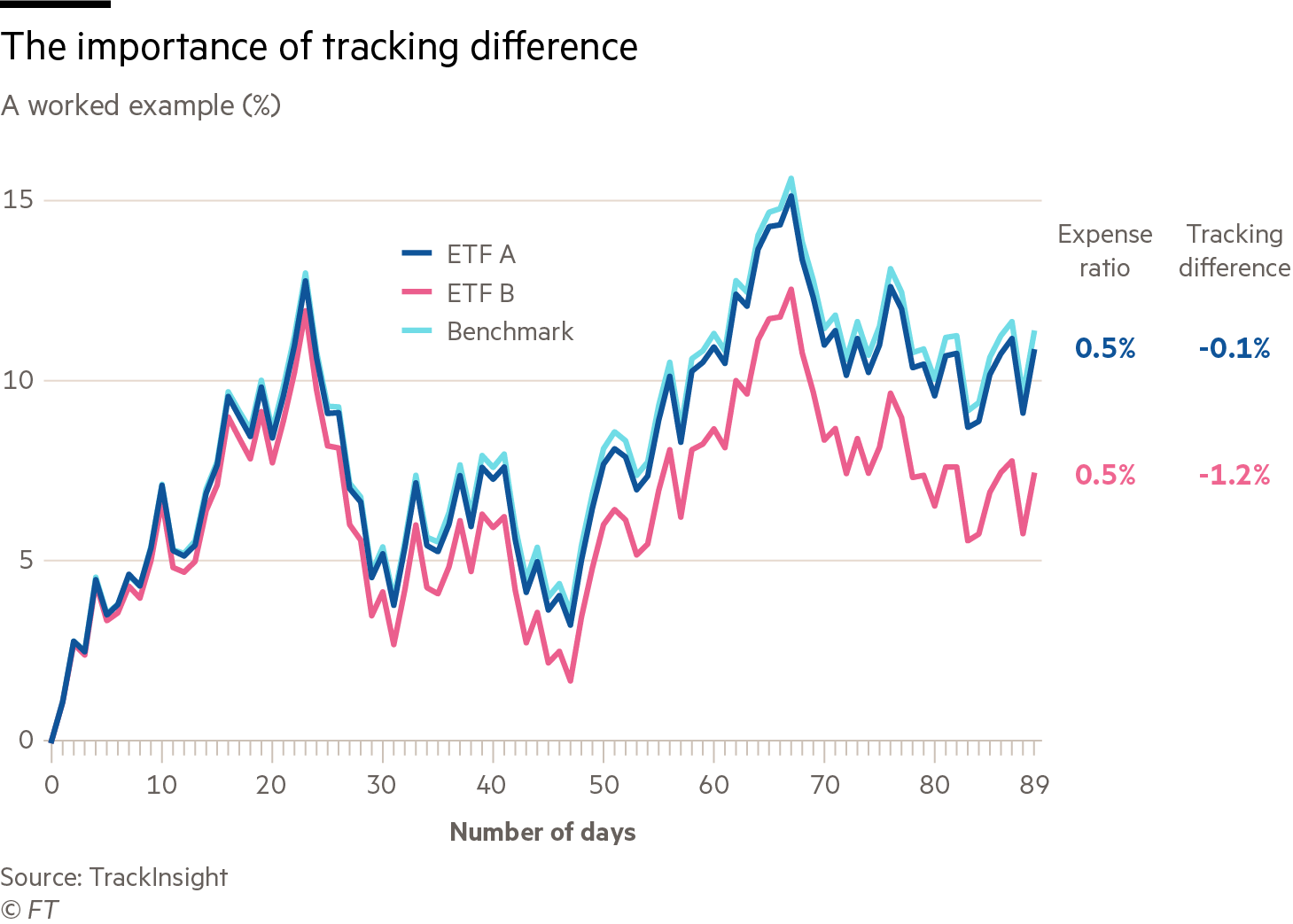

Sustainable portfolio management considers the carbon intensity of companies as the primary focus. By rebalancing the investment portfolio, the aim is to offset and reduce carbon emissions, aligning with the investor's values. One of the metrics used in this process is the tracking error, which represents the difference between the carbon intensity range of the managed portfolio and the benchmark portfolio. By maintaining a lower carbon intensity range than the benchmark portfolio, the goal is to minimize emissions and environmental impacts. This conscious and sustainable management allows for portfolio optimization, improving not only financial results but also contributing to sustainable practices and the reduction of environmental impacts in the current era.

Living The Oceans

Tool

Using the LivingTheOceans tool, you can define the carbon intensity you want to reduce from your portfolio and compare it to different benchmarks. The platform then shows the performance of the new portfolio compared to the benchmark and whether there is a loss or gain. By comparing different carbon ranges, you can see the performance of your choice compared to the benchmark and determine which range you feel most comfortable with based on your profile.

- Choose a favorite benchmark or build your own portfolio.

- Define your investor profile.

- Choose how much carbon you want to cut from your portfolio and compare performances.

- The algorithm also suggests the best combination according to your profile.

English (US)

English (US)

Português (BR)

Português (BR)